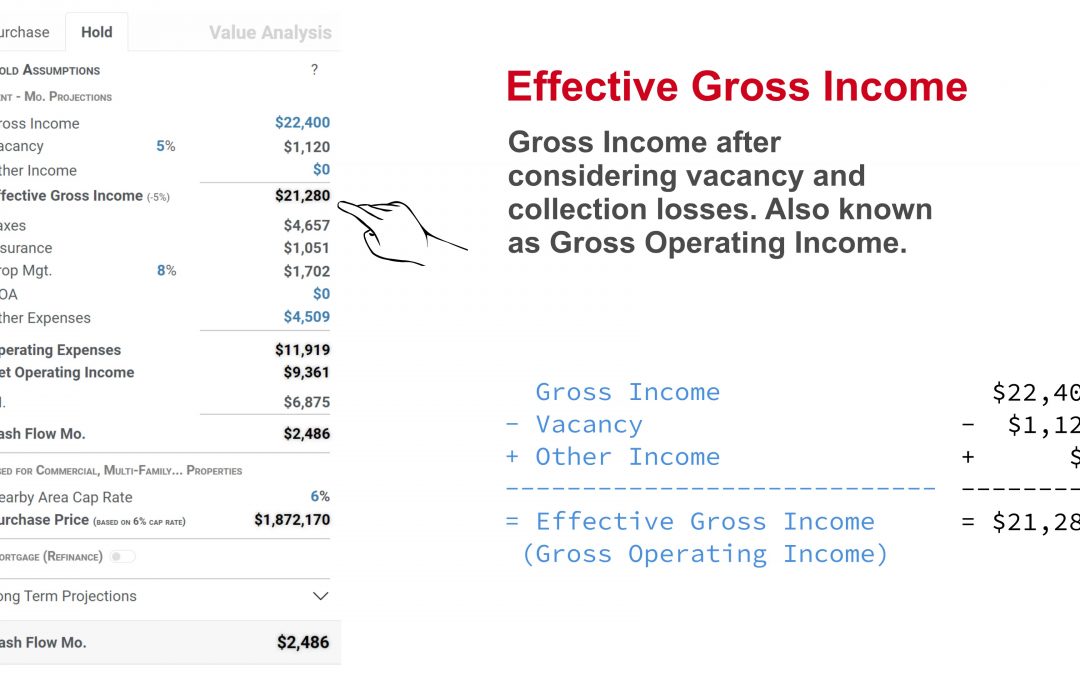

Property Flip or Hold – How to Calculate Hold Assumptions Rent – Mo. Projections

https://youtu.be/MEI2_0J2VuQ Gross Income - Total income of rent received from tenants to pay for the space. Vacancy Rate % - The percentage of time rental income is lost due to a property being not rented. Usually between 5% to 10% of the Gross Income. Other Income -...

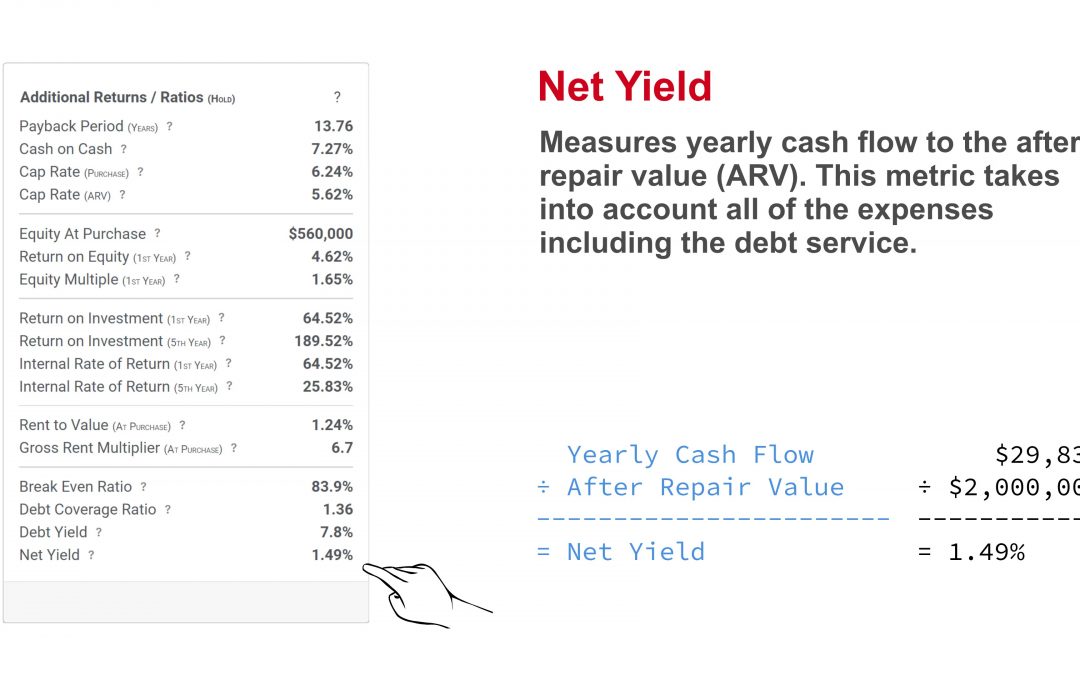

Property Flip or Hold – How to Calculate Net Yield

https://youtu.be/iJml7ZC8V_M Net Yield - Measures yearly cash flow to the after repair value (ARV). This metric takes into account all of the expenses including the debt service. Yearly Cash Flow ÷ After Repair Value ------------------------------ = Net Yield $29,832...

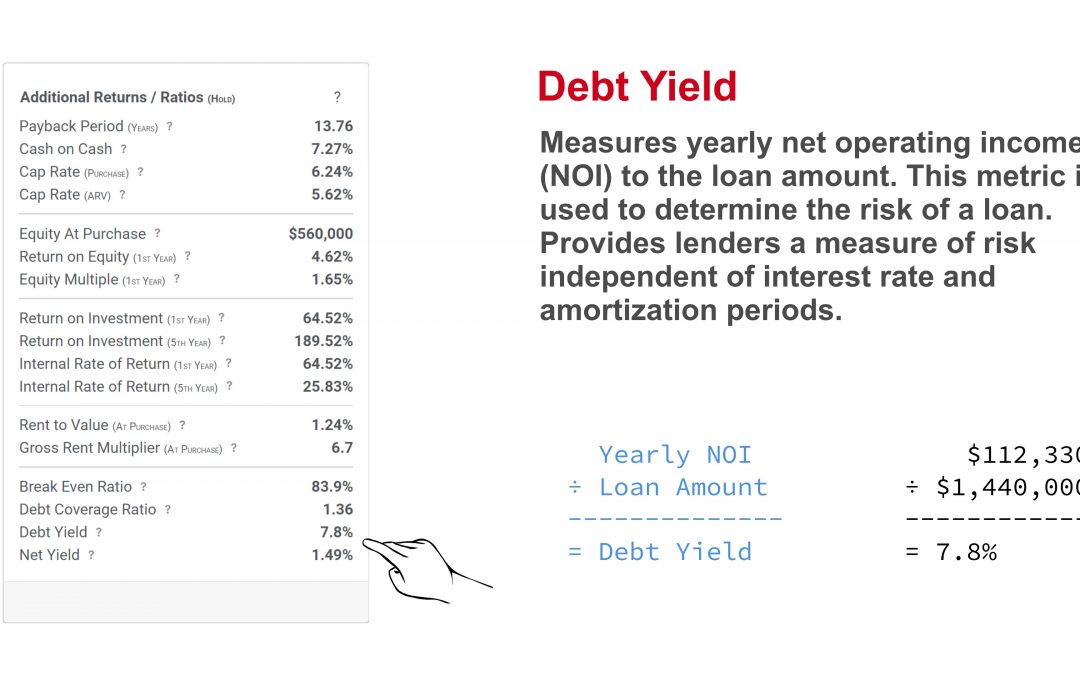

Property Flip or Hold – How to Calculate Debt Yield

https://youtu.be/kSNBFO-ZysQ Debt Yield - Measures yearly net operating income (NOI) to the loan amount. This metric is used to determine the risk of a loan. Provides lenders a measure of risk independent of interest rate and amortization periods. Yearly Net Operating...

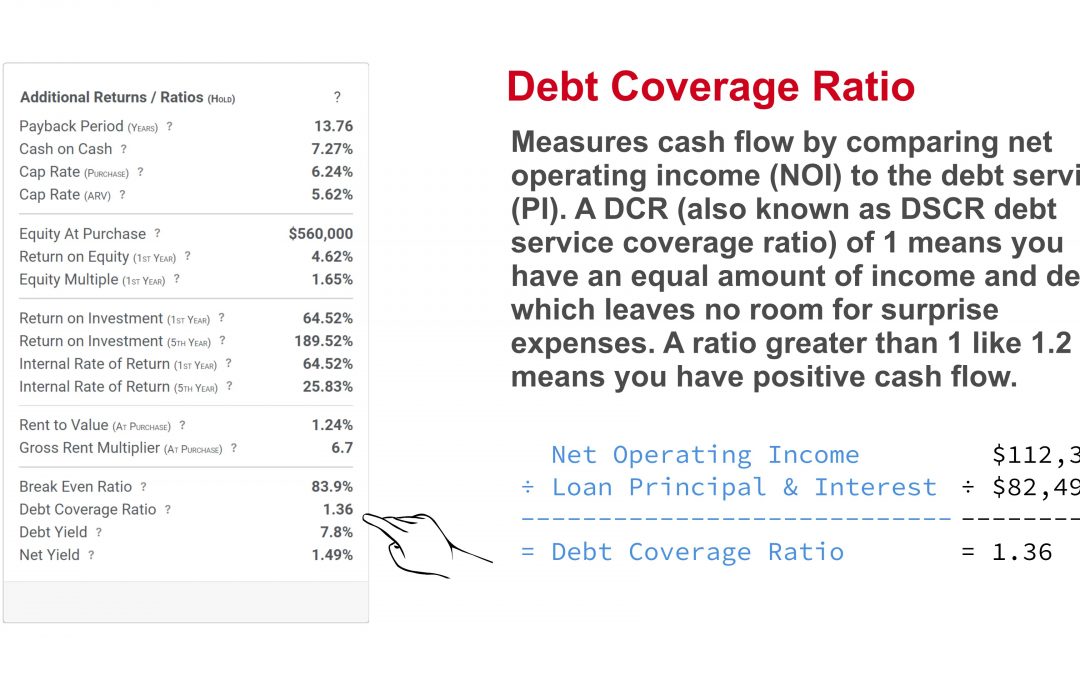

Property Flip or Hold – How to Calculate Debt Coverage Ratio

https://youtu.be/cTRgF4Gb4R8 Debt Coverage Ratio - Measures cash flow by comparing net operating income (NOI) to the debt service (PI). A DCR (also known as DSCR debt service coverage ratio) of 1 means you have an equal amount of income and debt which leaves no room...

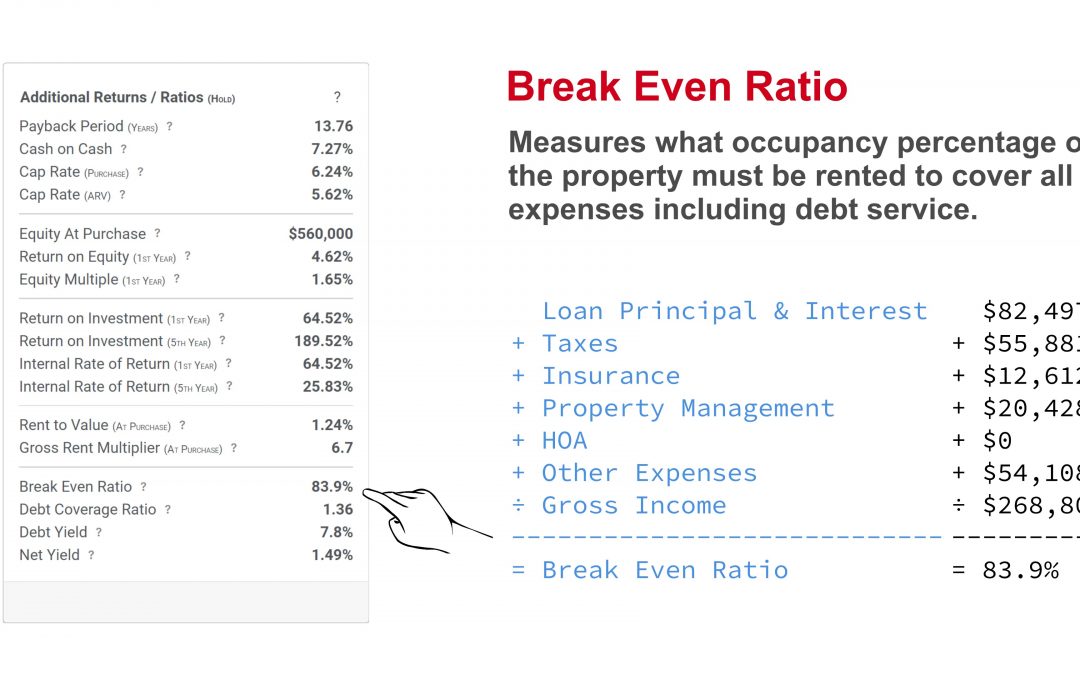

Property Flip or Hold – How to Calculate Break Even Ratio

https://youtu.be/GI3ZEcEjTk0 Break Even Ratio - Measures what occupancy percentage of the property must be rented to cover all expenses including debt service. Loan Principal & Interest + Taxes + Insurance + Property Management + HOA + Other Expenses ÷ Gross...

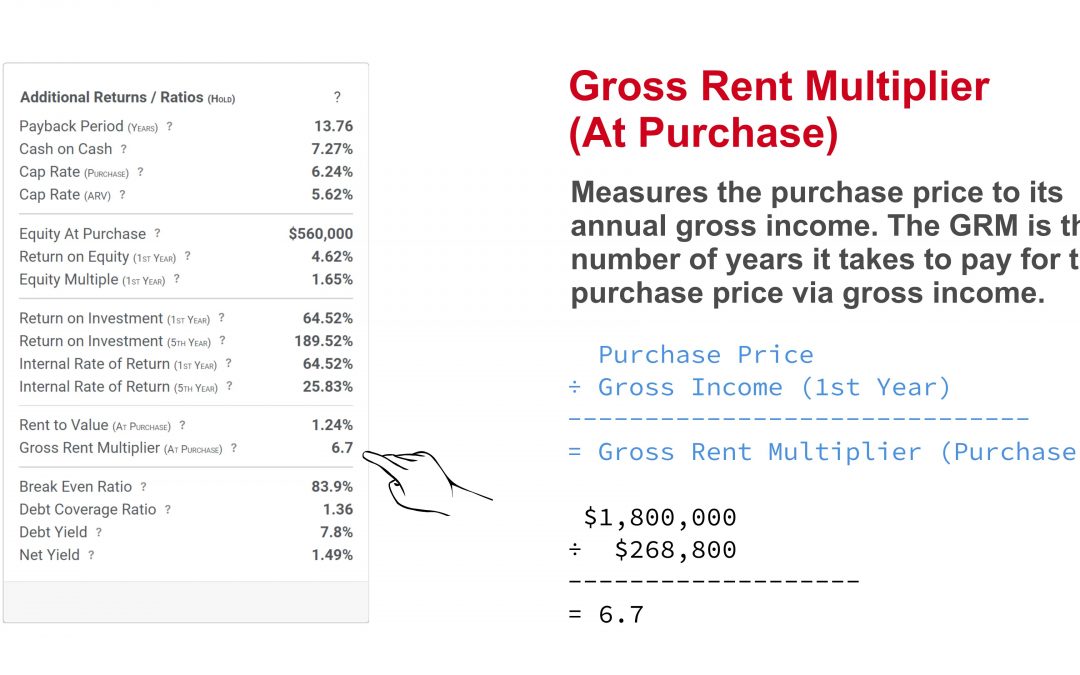

Property Flip or Hold – How to Calculate Gross Rent Multiplier (At Purchase)

https://youtu.be/OdJzZRCIY28 Gross Rent Multiplier (At Purchase) - Measures the purchase price to its annual gross income. The GRM is the number of years it takes to pay for the purchase price via gross income. Purchase Price ÷ Gross Income (1st Year)...