Calculations

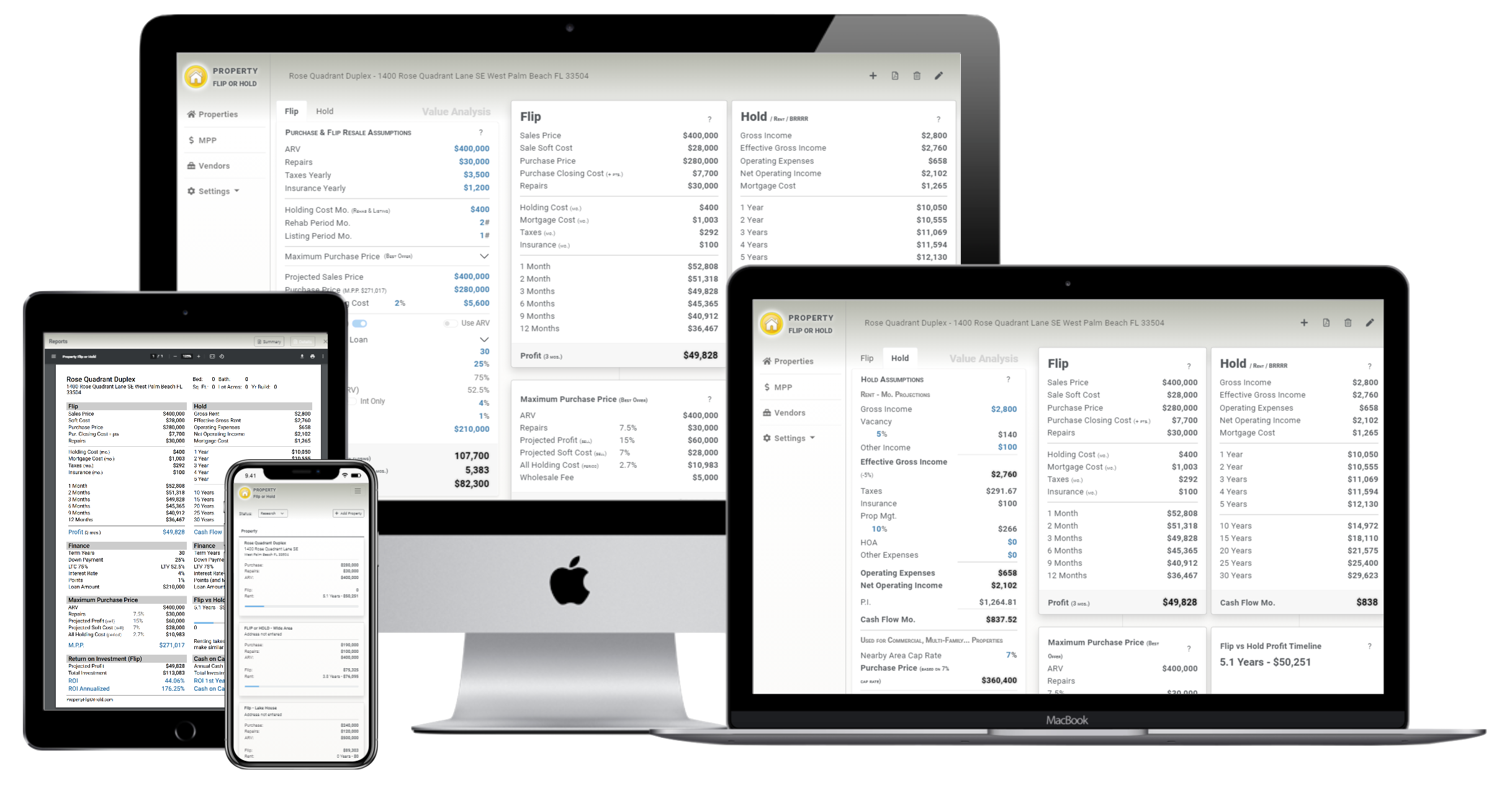

Flip or Hold Analysis

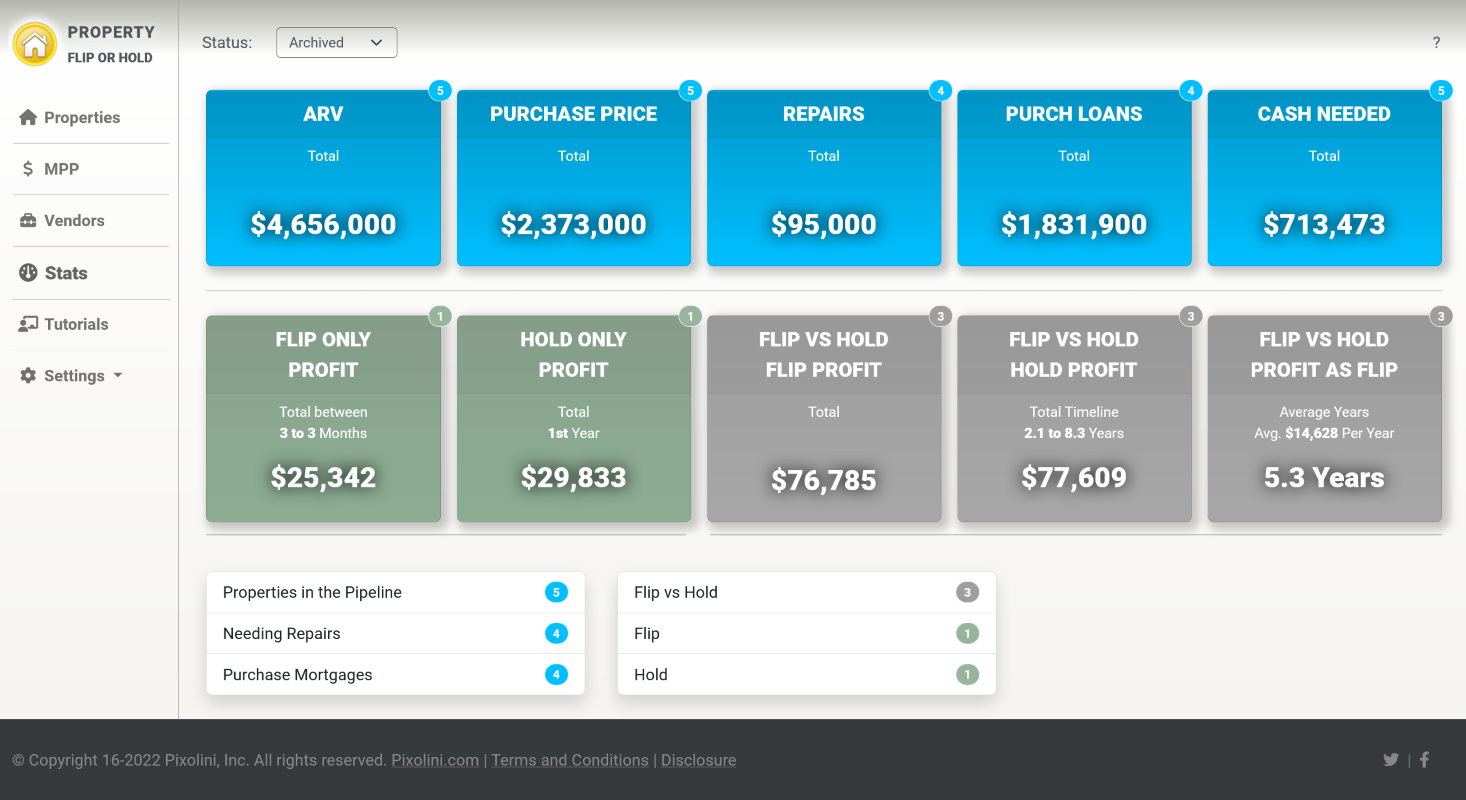

- Analyze Flip or Hold Scenarios from one screen

- No Complex Calculations

- No Long Drawn-out Analysis

- Real Estate Investments made easy

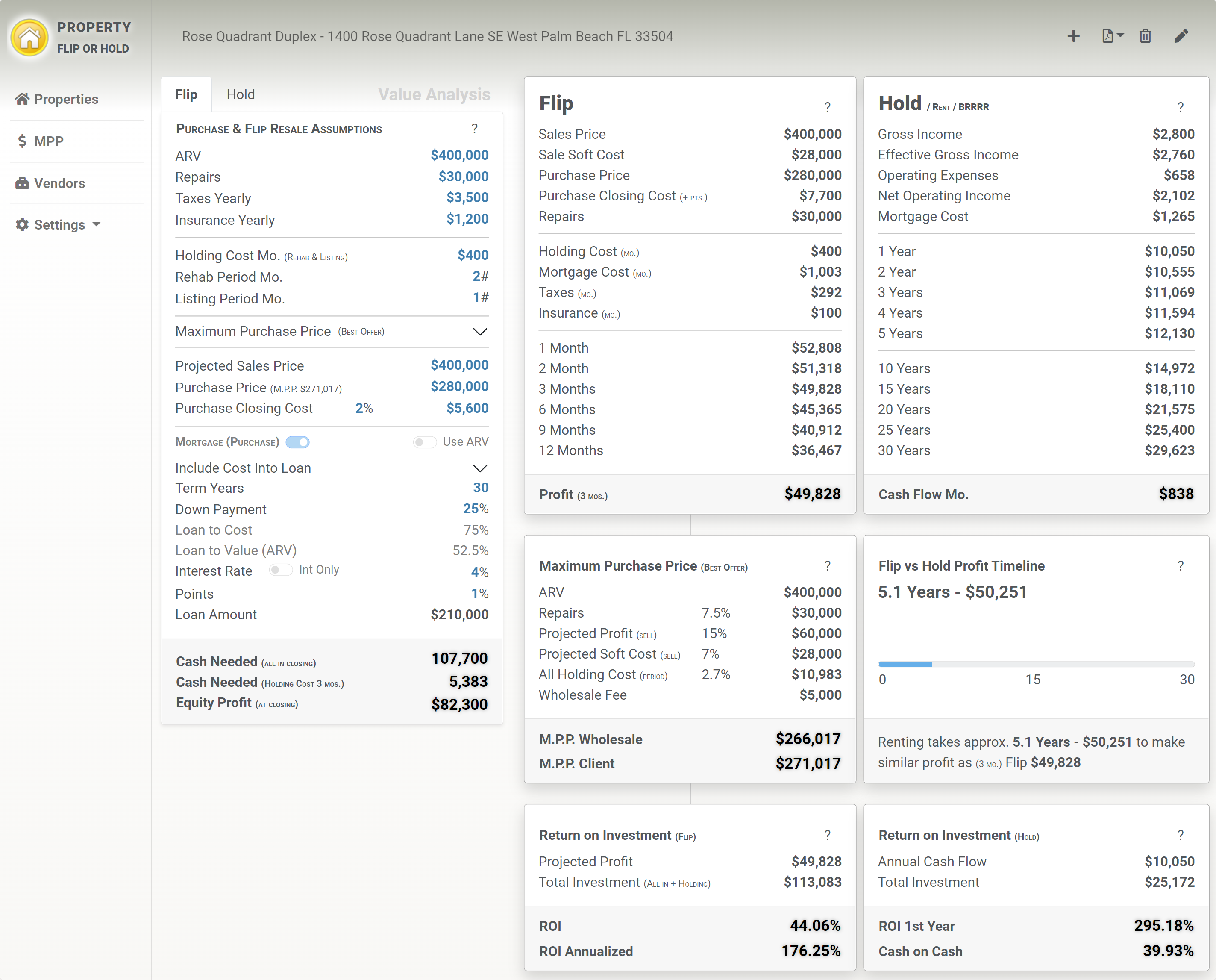

Quickly analyze Flip or Hold in 2 easy steps.

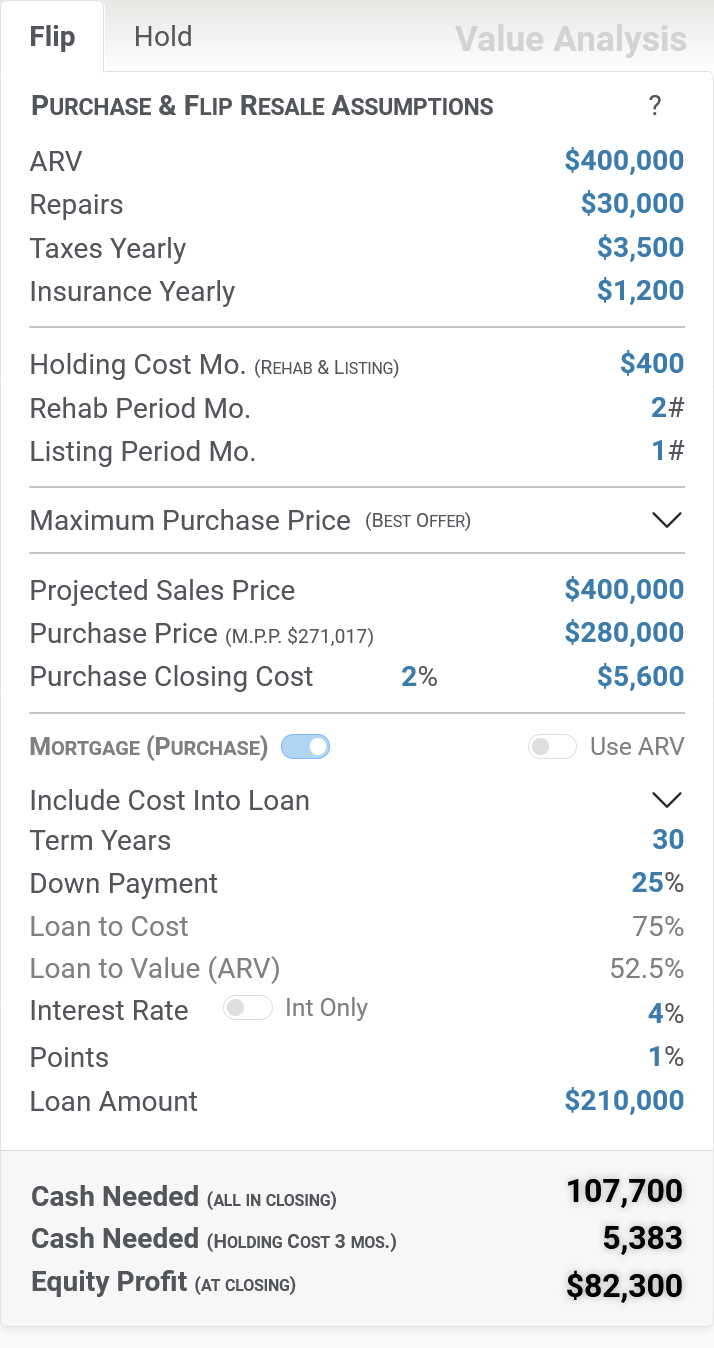

Step 1: Flip Assumptions

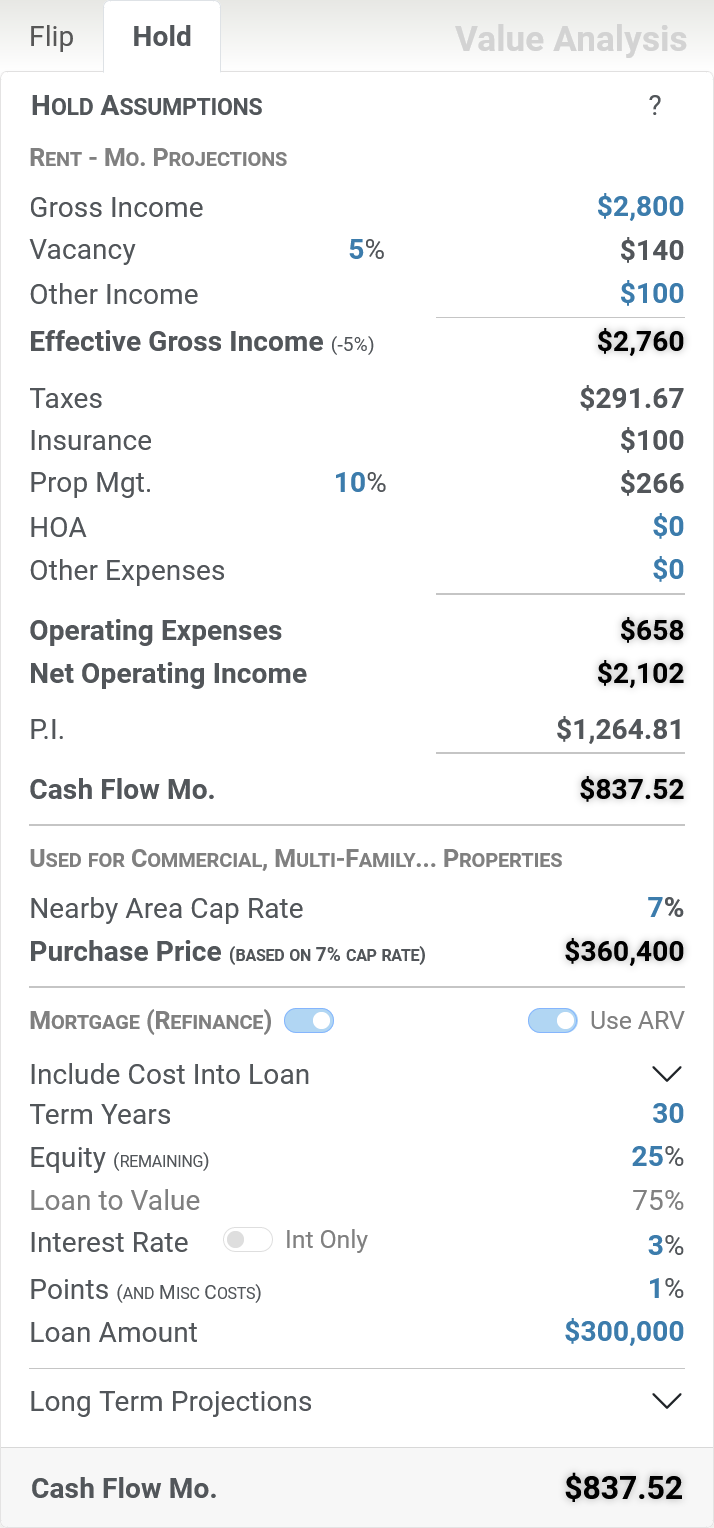

Step 2: Hold Assumptions

Live Results: View results on the same screen

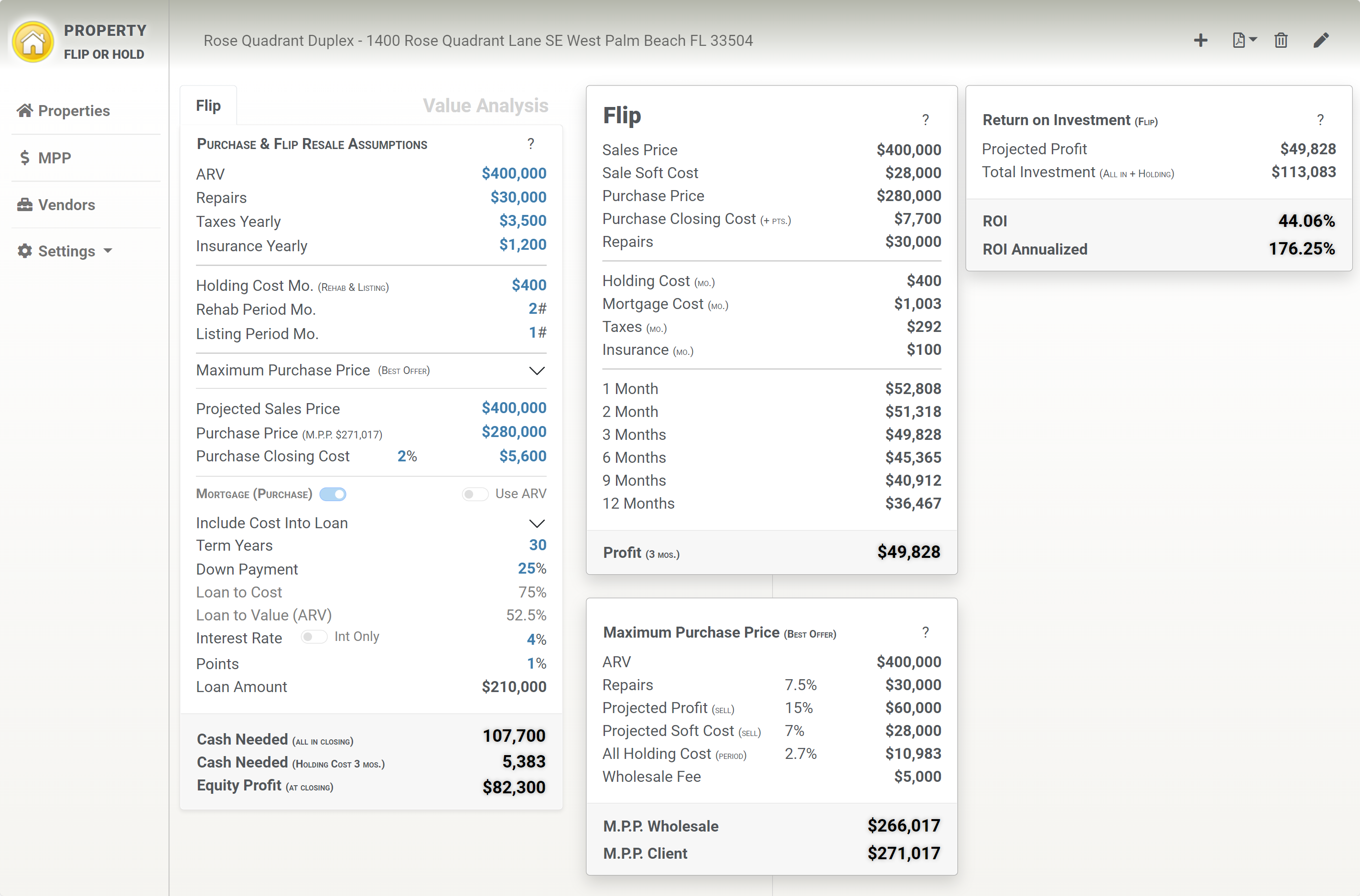

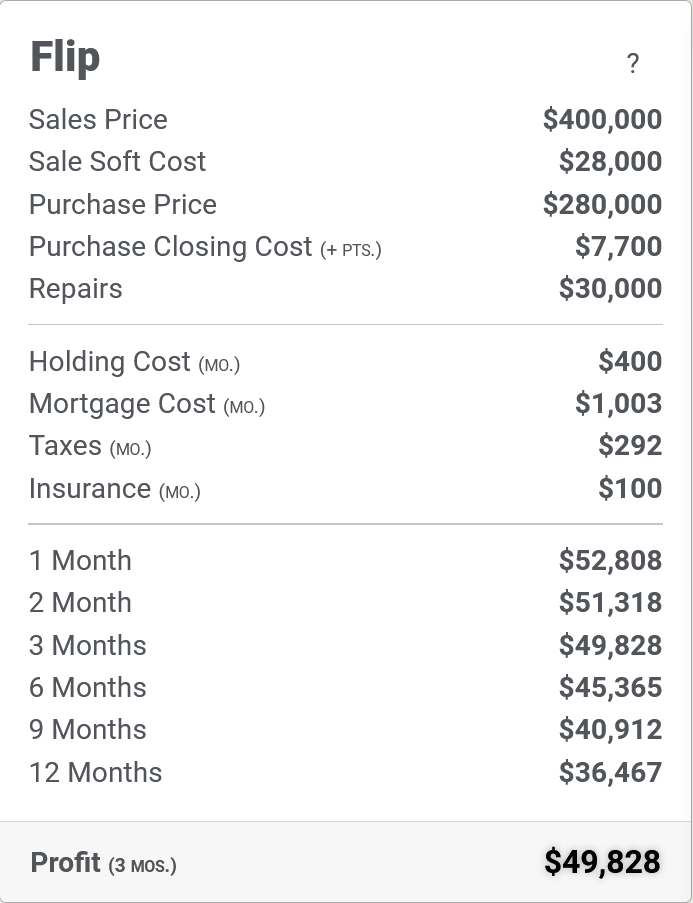

Quickly analyze Flip in 2 easy steps.

Step 1: Purchase Assumptions

Step 2: Flip Assumptions

Live Results: View results on the same screen

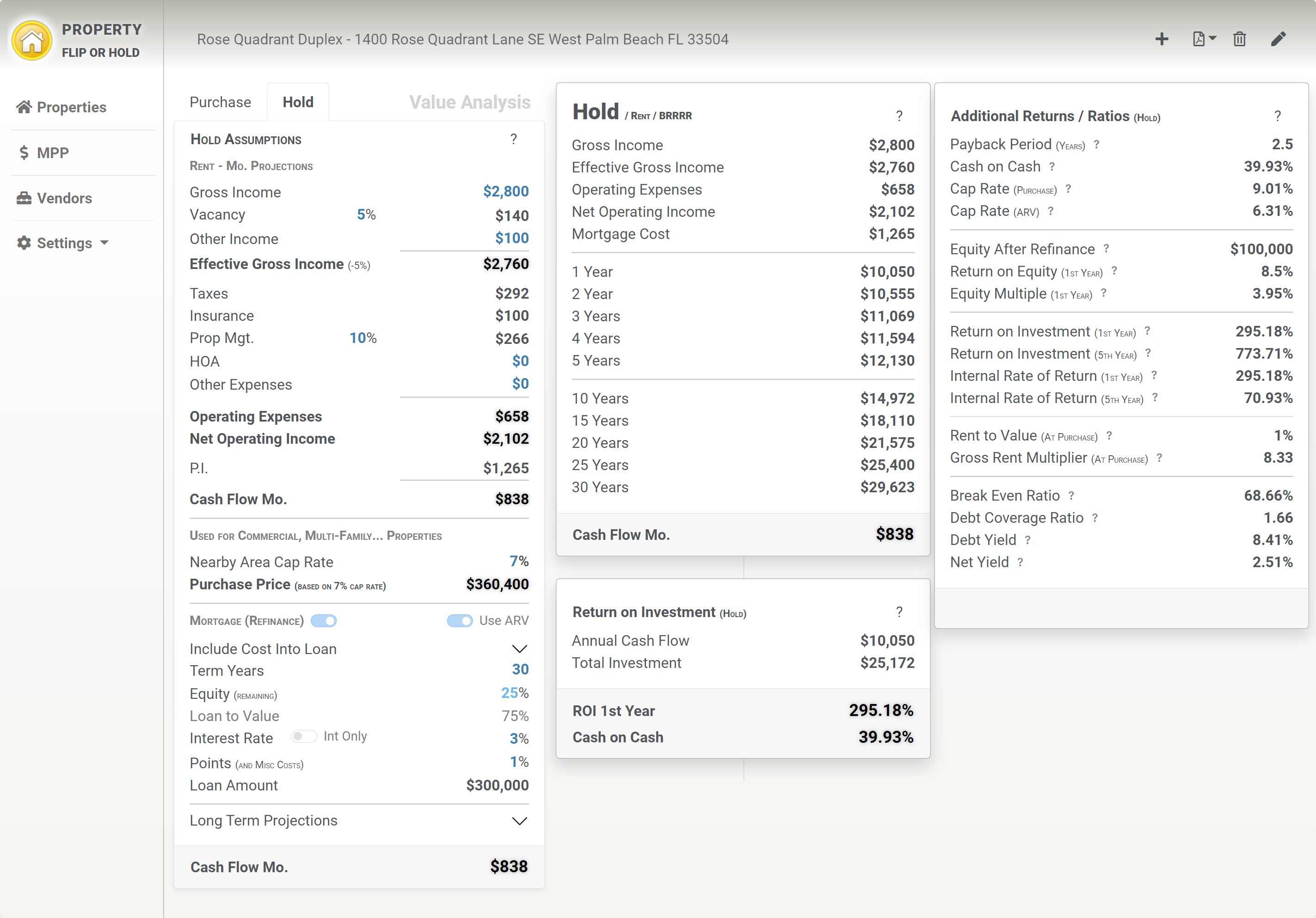

Quickly analyze Hold in 2 easy steps.

Step 1: Purchase Assumptions

Step 2: Hold Assumptions

Live Results: View results on the same screen

Maximize your profits and streamline your decision-making with Property Flip or Hold – the ultimate real estate investing software. Our user-friendly tools make it easy to calculate and compare profits for flipping or holding properties. Whether you’re a seasoned investor or a new investor looking for a quick flip or seeking passive income through renting, our software has got you covered. With no complex calculations or long drawn-out analysis, our software makes it easy to analyze flip or hold scenarios from one screen. Invest smart and take your real estate portfolio to new heights with Property Flip or Hold.

Step 01.

Enter Flip Assumptions

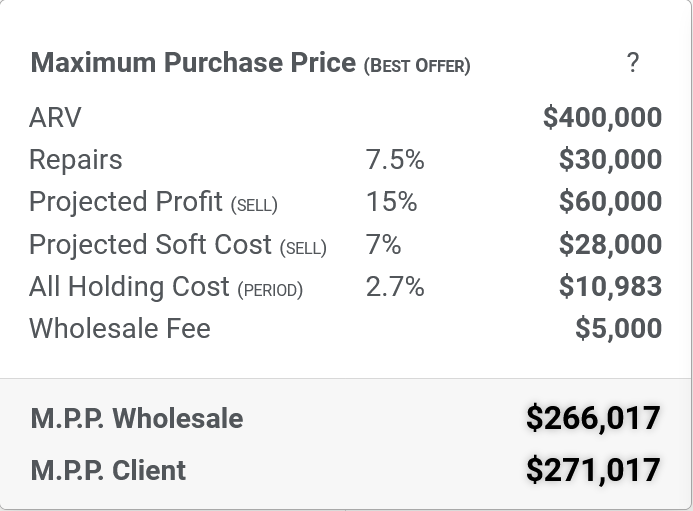

Enter your ARV, Repairs, Taxes, Insurance, Holding Cost during Rehab/List, Projected Profit, Cost, any Wholesale Fee, and Loan Information. Maximum Purchase Price (best offer), Cash Needed at Closing, Cash Needed for Holding Cost, Your Equity Profit (at closing) are automatically calculated.

Step 02.

Enter Hold Assumptions

Gross Income, Vacancy Rate, Property Management, additional Expenses, and Loan Information.

Live Results.

Constantly see your results

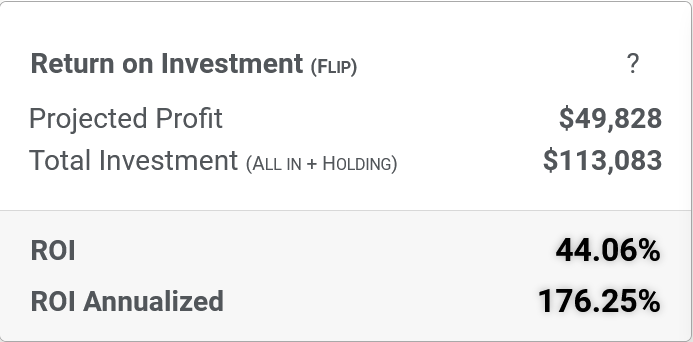

- Flip Profit

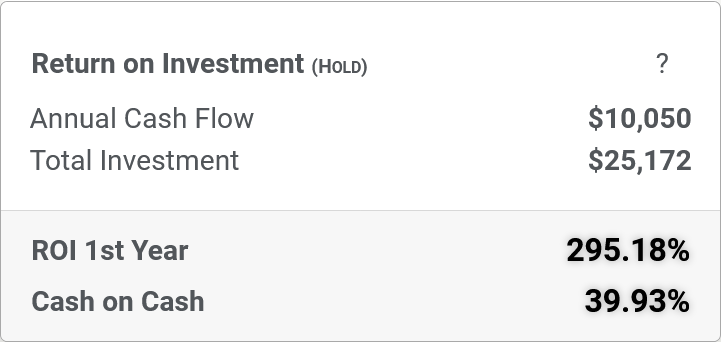

- Hold/Rent/BRRRR Profits

- Maximum Purchase Price

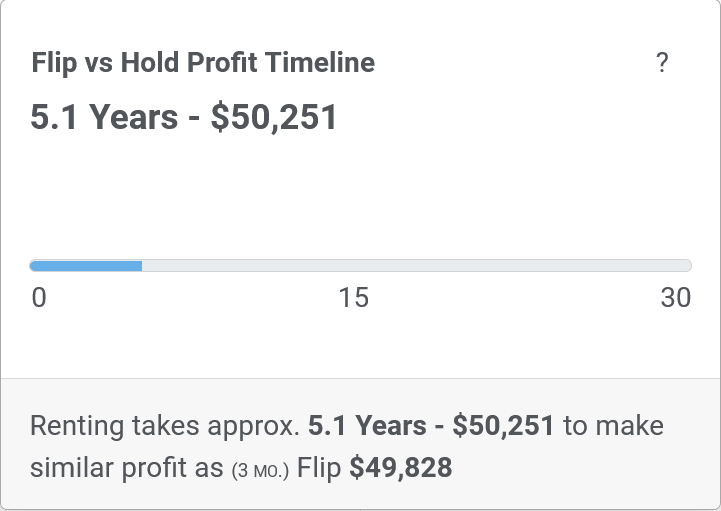

- Flip -vs- Hold Profit Timeline

- Return on Investment for Flip and Hold

Live Results

Live Results are Side by Side Comparison

Live Results

Compare your Flip vs Hold Analysis

Stats Dashboard

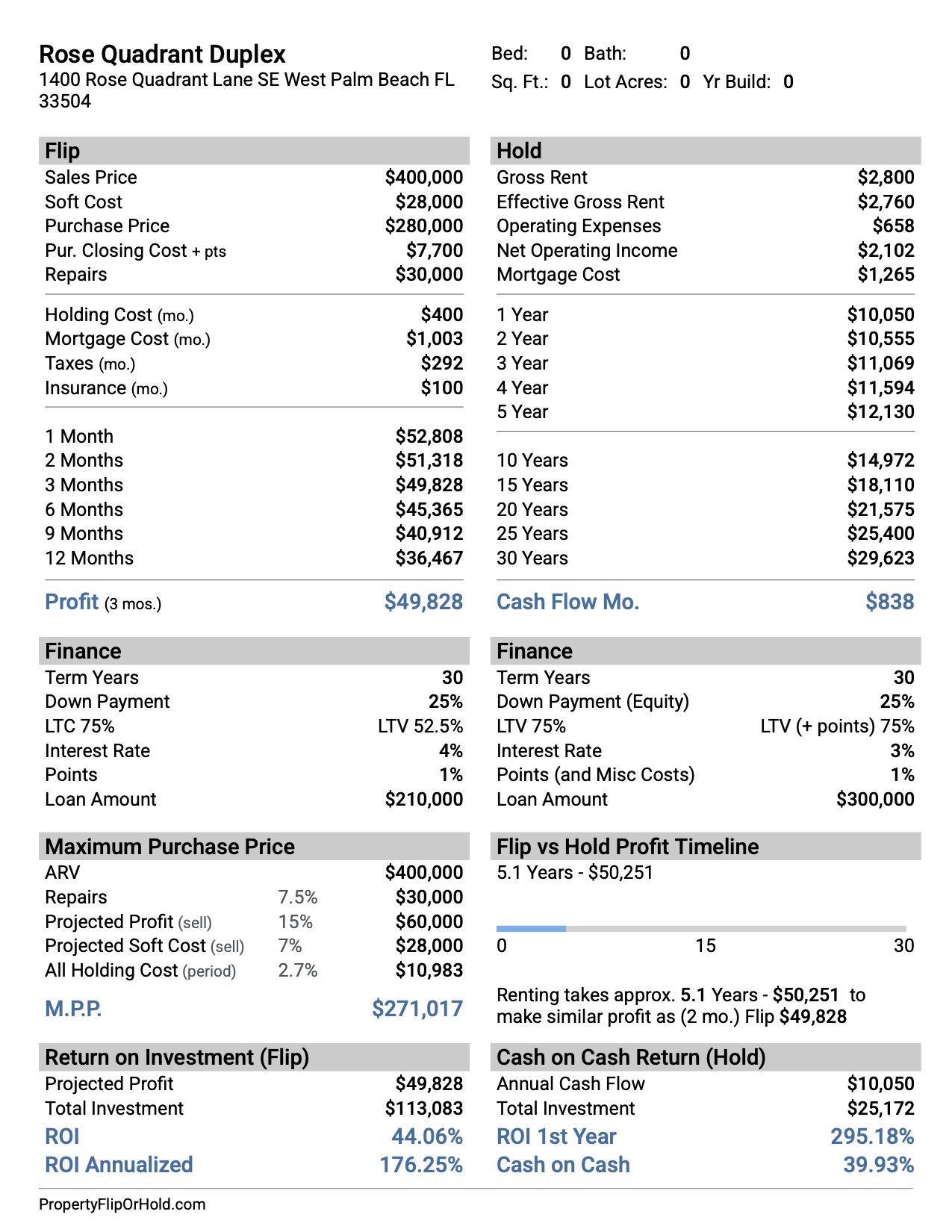

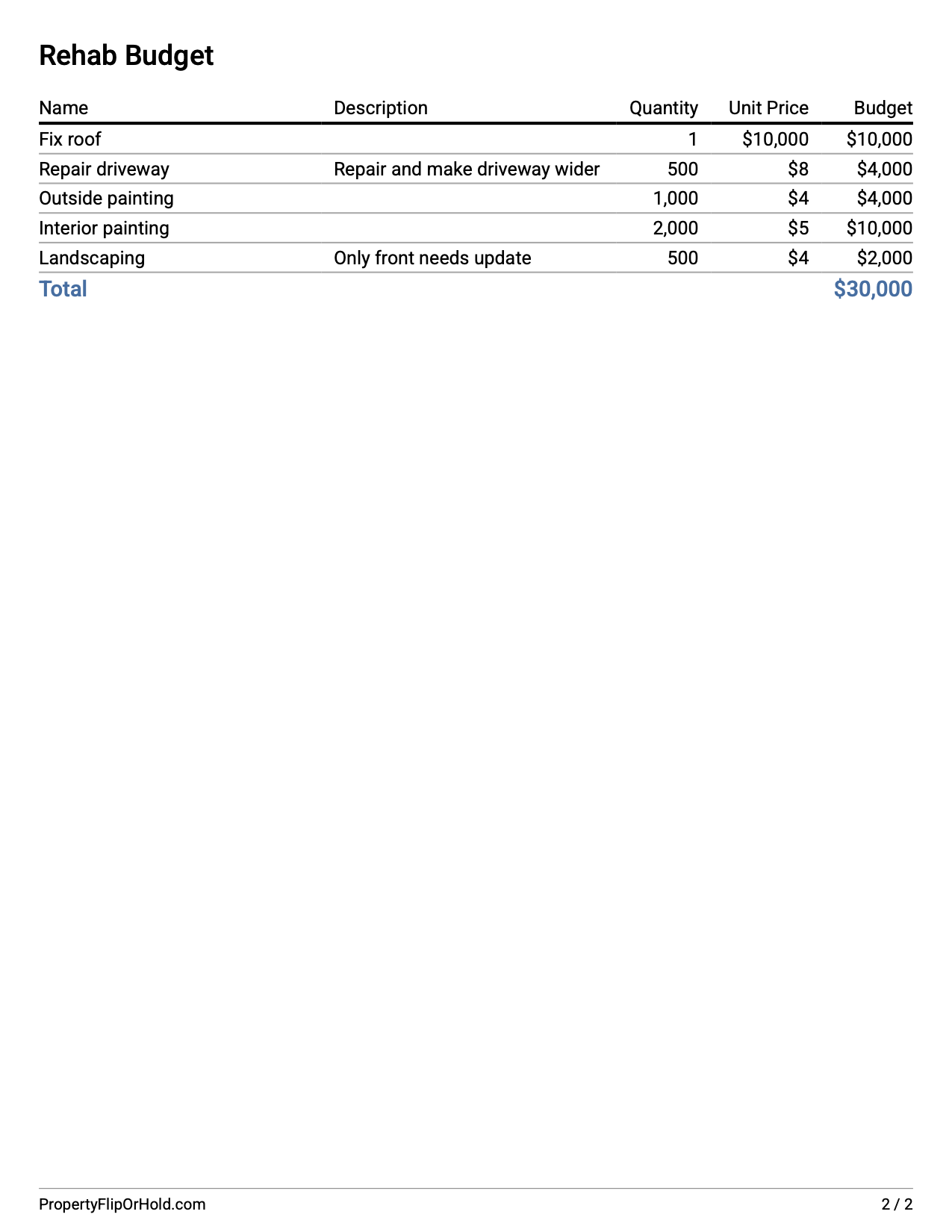

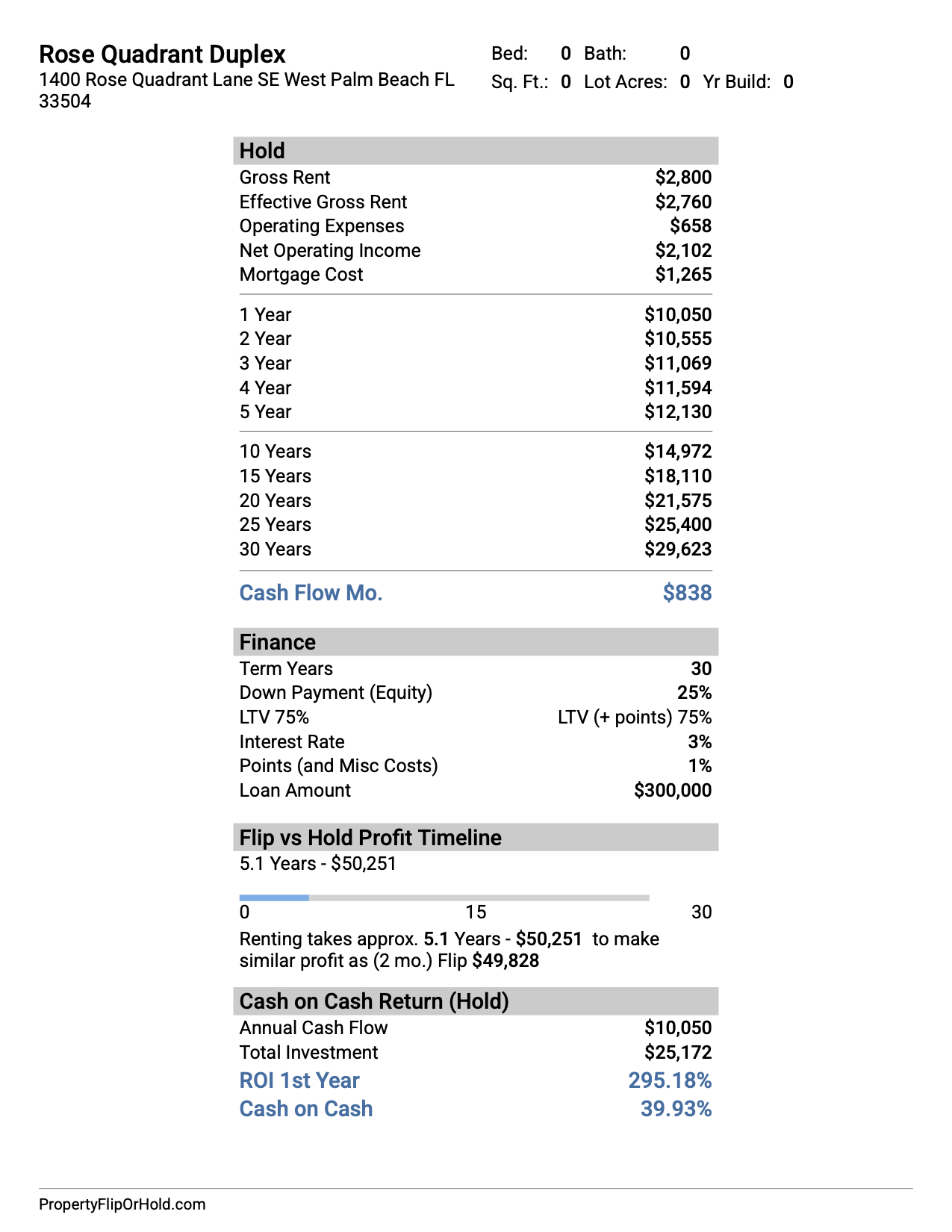

REPORT – RETURN ON INVESTMENT, DETAILED REHAB BUDGET OR ONE BULK SUM

One Page

Flip or Hold Comparision

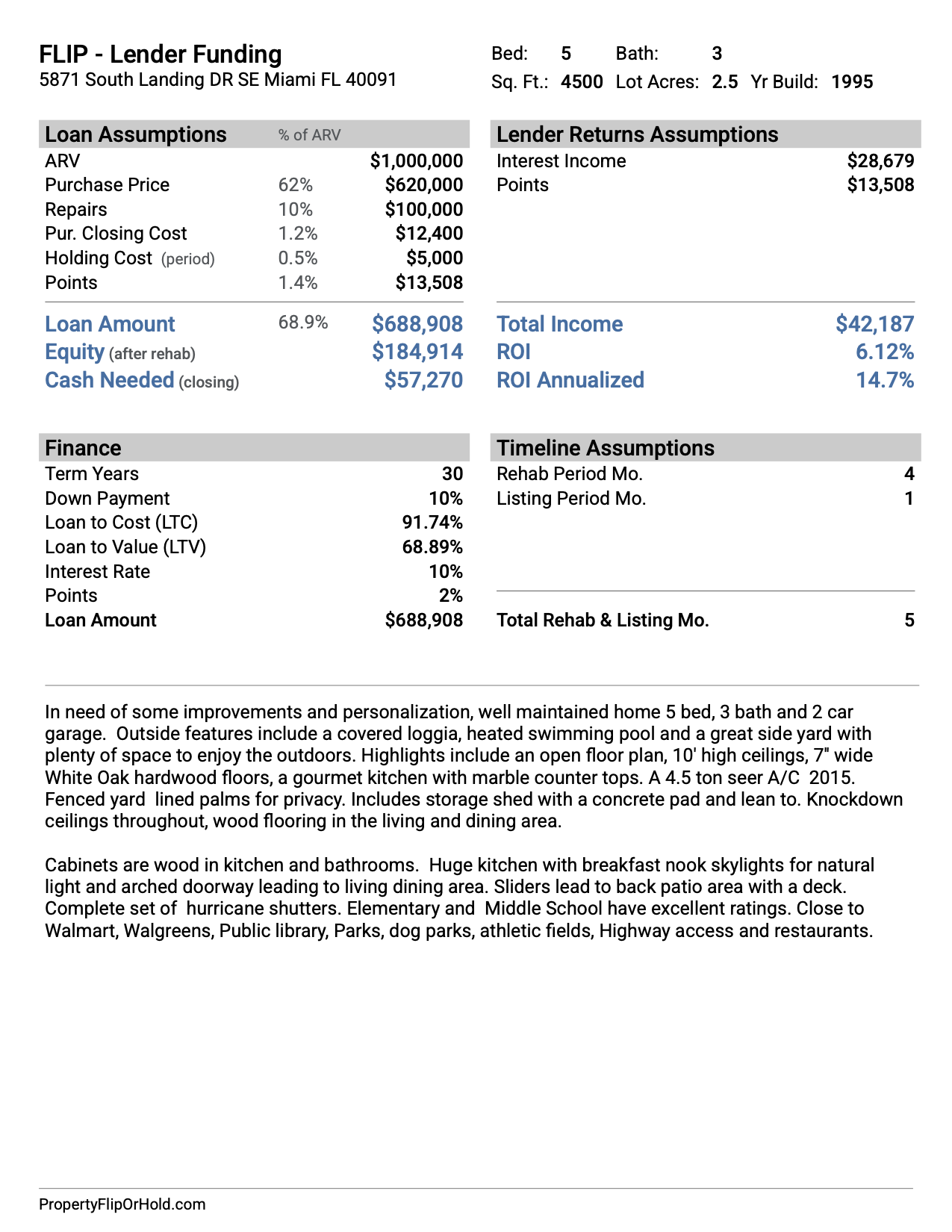

Lender Funding Summary Letter