Key Features

Flip or Hold Analysis

- Analyze Flip or Hold Scenarios from one screen

- No Complex Calculations

- No Long Drawn-out Analysis

- Real Estate Investments made easy

K E Y F E A T U R E S

- Exit Strategy Scenarios

- Flip or Hold

- Rehab, Flip, Hold

- Flip

- Hold

- Hold/BRRRR

- Wholesale

- Change analysis type on the fly

- Flip Sliding Profit scale up to 12 months

- Hold Profit scale up to 30 years

- Holding Cost

- Holding Cost Mo. (Rehab & Listing)

- Rehab Period Mo.

- Listing Period Mo.

- Financing Options

- Cash

- Purchase Loans

- Refinance Loans

- Amortization Years

- Term Years (Balloon)

- Principal Interest

- Interest Only

- Points

- Cash Out Loans

- Financing – Include Cost Into Loan

- Rehab

- Purchase Closing Cost

- Holding Cost

- Points

- Analyze Maximum Purchase Price

- Projected Profit (sell)

- Projected Soft Cost (sell)

- Holding Cost (3 mos.)

- Mortgage Cost (3 mos.)

- Taxes (3 mos.)

- Insurance (3 mos.)

- Purchase Closing Cost (2 %)

- Wholesale Fee

- Purchase Analysis

- Cash Needed (all in closing)

- Cash Needed (Holding Cost 3 mos.)

- Equity Profit (at closing)

- Hold Assumptions

- Gross Income

- Effective Gross Income

- Operating Expenses

- Net Operating Income

- Cash Flow Mo.

- Long Term Projections

- Appreciation (per Year)

- Income Increase (per Year)

- Expense Increase (per Year)

- Depreciation Period (Years)

- Land Value

- Flip vs Hold Profit Timeline

- BreakEven Profit Timeline

- Renting takes approx. 5.4 Years $71,251 to make similar profit as (3 mo.) Flip $70,630

- Returns / Ratios

- Projected Profit

- Total Investment

- Return on Investment (Flip)

- Return on Investment (Hold)

-

- Payback Period (Years)

- Cash on Cash

- Cap Rate (Purchase)

- Cap Rate (ARV)

-

- Cash Out Refinance

- Equity After Refinance

- Return on Equity (1st Year)

- Equity Multiple (1st Year)

-

- Return on Investment (1st Year)

- Return on Investment (5th Year)

- Internal Rate of Return (1st Year)

- Internal Rate of Return (5th Year)

-

- Rent to Value (At Purchase)

- Rent to Value (ARV)

- Gross Rent Multiplier (At Purchase)

- Gross Rent Multiplier (ARV)

-

- Break Even Ratio

- Debt Coverage Ratio

- Debt Yield

- Net Yield

- Help System

- Full Video Tutorials

- Blog Posts

- Help descriptions for each sections

- Help with each calculation formula

- Fully transparent

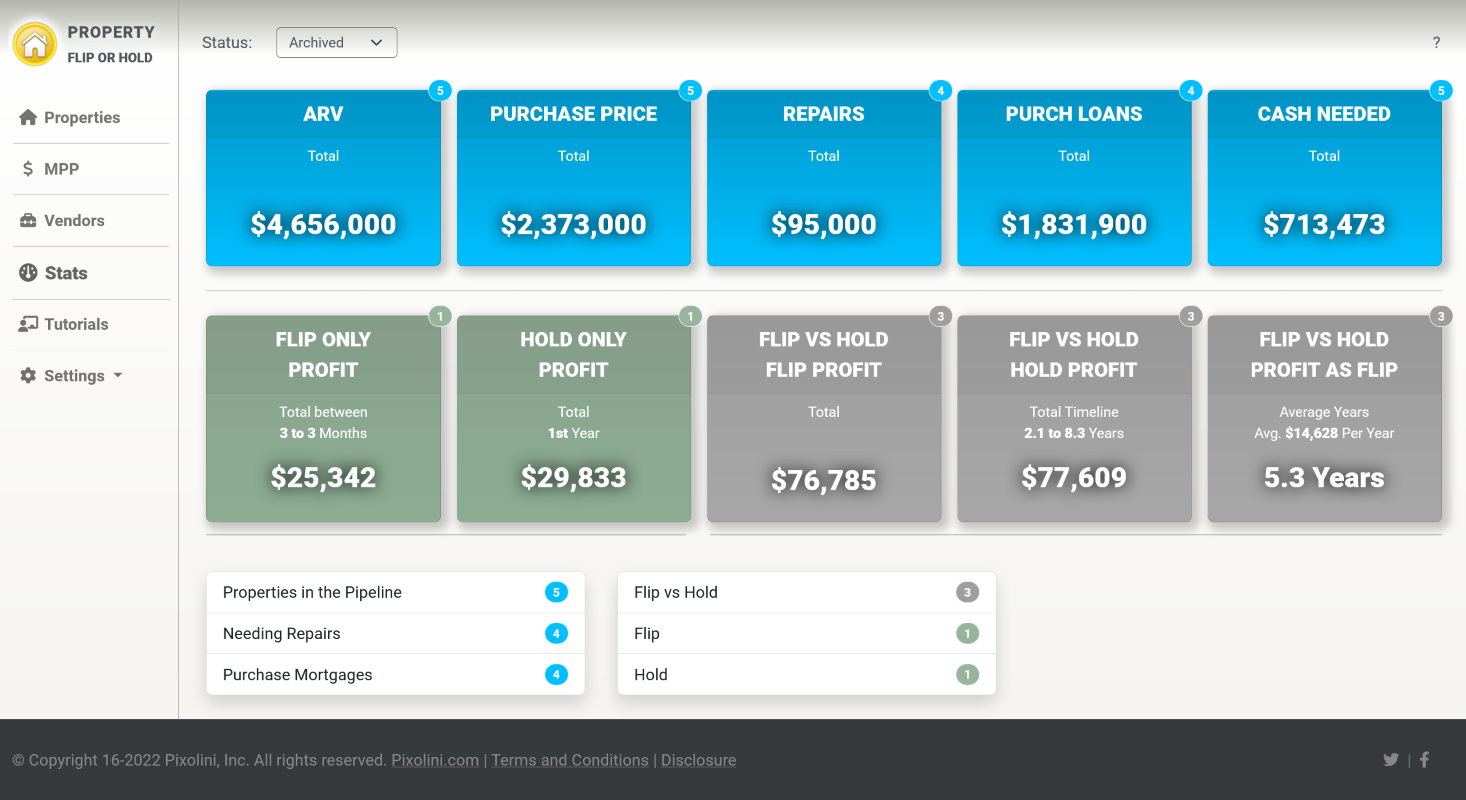

- Stats Dashboard

- View pipeline overall status

- Total ARV

- Purchase Price

- Repairs

- Purchase Loans

- Cash Needed

- Flip

- Hold

- Flip vs Hold Profits and Timelines

- Reports

- Flip vs Hold

- Flip

- Hold

- Summary

- Returns and Ratios

- Income Details

- Rehab Details

- Lender Funding Letter

- Save to PDF

- Take your PDF report and share it

- Vendor Information

- Store your vendor’s information

- Tag vendors by type

- Contact information with notes and results on workmanship

Maximize your profits and streamline your decision-making

Discover the ultimate real estate investing tool with Property Flip or Hold. Whether you’re a seasoned investor looking to take your profits to the next level or a new investor just starting out, our user-friendly software makes it easy to calculate and compare potential profits for flipping or holding properties. With no complex calculations or long drawn-out analysis, our software streamlines the decision-making process. Analyze flip or hold scenarios all from one screen and make informed investment decisions. Whether you’re looking for a quick flip or steady passive income through renting, Property Flip or Hold has got you covered. Take the guesswork out of real estate investing and trust Property Flip or Hold to guide your investments to success.