When purchasing a home for investment with the intent to Hold (Rent) you need to consider your Cash on Cash Return. Why is it important? This is a quick way to figure our your ROI (Return on Investment) as a percent of return for your cash investment. I know I keep saying this but in Real Estate Investment you make your profit when you purchase and you need a way to measure your return.

So, how do you arrive at the Cash on Cash Return? Hey, it’s just math :). Let’s setup a scenario.

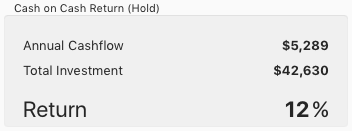

- Annual Cashflow – We take the Net Operating Income – Debt Service. The Net Operating Income is calculated by taking the Gross Rent – Expenses. The Debt Service, if any is the Principal and Interest Payment. In our case we have a Monthly Gross Rent of $1,300 and Monthly Expenses of $405. What are the Monthly Expenses? Taxes, Insurance, Property Management (usually 10%), Vacancy Factor (5% depending your location), Home Association Fees. We take $1,300 – $454 which gives use a Net Operating Income of $895. In our case we have a Mortgage of $80,000 for 360 Months at 5.5% which gives us a Monthly P.I. (Principal and Interest) of $454. We take the Net Operating Income $895 – Mortgage Cost of $454 * 12 months which gives us an Annual Cashflow of $5,289.

- Total Investment – We take the Purchase Price + Repairs + Holding Cost – Mortgage Loan Amount. Our Purchase Price is $52,500 + Repairs $70,000 + Holding Cost – Mortgage Loan Amount $80,000 = $42,630 of Total Cash Investment.

- Return – We take the (Annual Cashflow / Total Investment) * 100. Our (Annual Cashflow $5,289 / Total Investment $42,630) * 100 = 12.40% which I rounded to 12%.

It’s time to put it all together and see what our Cash on Cash Return should be.

| Annual Cashflow | $5,289 |

| Total Investment | $42,630 |

| Return | 12% |

PROPERTY FLIP OR HOLD

You must be logged in to post a comment.