Quickly calculate your Best Offer, the Maximum Purchase Price on an investment property.

When purchasing a home for investment with the intent to Flip or Hold you need to consider what your Maximum Purchase Price should be for each deal. In Real Estate Investment you make your profit when you purchase.

So, how do you arrive at the Maximum Purchase Price? It’s actually pretty straightforward. Let’s set up a scenario.

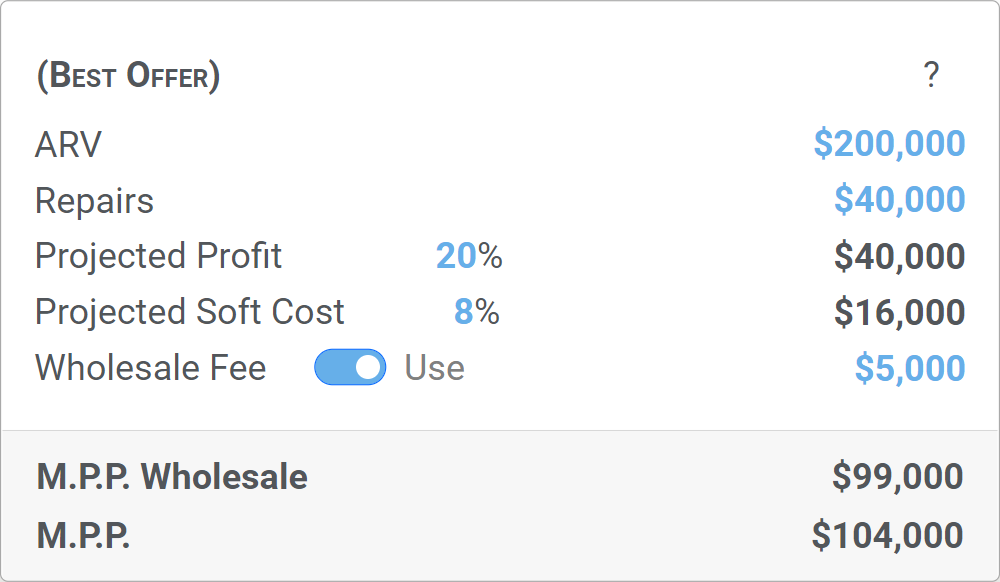

- ARV — First we need to figure out what the ARV (After Repair Value) will be after fixing/rehabbing the property and in this case, it will be $200,000.

. - Repairs — We need to figure out what the Repairs (Rehab cost) will be in order to bring the property up to code, fixed/rehabbed, and looking great. In our case, it will cost about $40,000.

. - Projected Profit Required — We need to figure out what our Profit needs to be and we will use 20% of the ARV which will be $40,000. The Profit Percentage is something that you need to be comfortable with that it will be enough for all of the work involved.

. - Projected Soft Cost / Holding Cost — Soft Cost includes items like Real Estate Commission, Architectural, engineering, financing, legal fees, and other pre and post-construction expenses. You’ll need to also include the holding cost during the rehab and listing period. For example, the amount to keep the property running during the Rehab/Listing Period like Electric, Water, Alarm System, Mortgage Payment, Taxes, Insurance, and Purchase Closing Cost. Let’s use 8% which will be $16,000 but this number depends on the situation for each property. Perhaps we need to add an additional structure and the Architectural price would be higher or none at all.

. - Wholesale Fee — If this is a Wholesale deal it’s the fee that you would like to collect. This is only visible to you and will not appear in the property report. Let’s enter the $5,000 fee.

. - M.P.P. — Lastly we calculate the M.P.P. (Maximum Purchase Price or Best Offer) by taking the ARV — Repairs — Projected Profit Required — Projected Soft Cost — Wholesale Fee. This gives us the Maximum Purchase Price (Best Offer with our conditions) at $104,000.

It’s time to put it all together and see what our Maximum Purchase Price should be.

Maximum Purchase Price (Best Offer) based on our conditions